🥦Delta Exposure(DEX)

Quick Overview

Delta in Detail

Significance of Delta

What is Delta Exposure?

Understanding Delta Exposure and Dealer Hedging Behavior

Buying IBM 18-Nov-16 160 Strike Call Option

Q & A

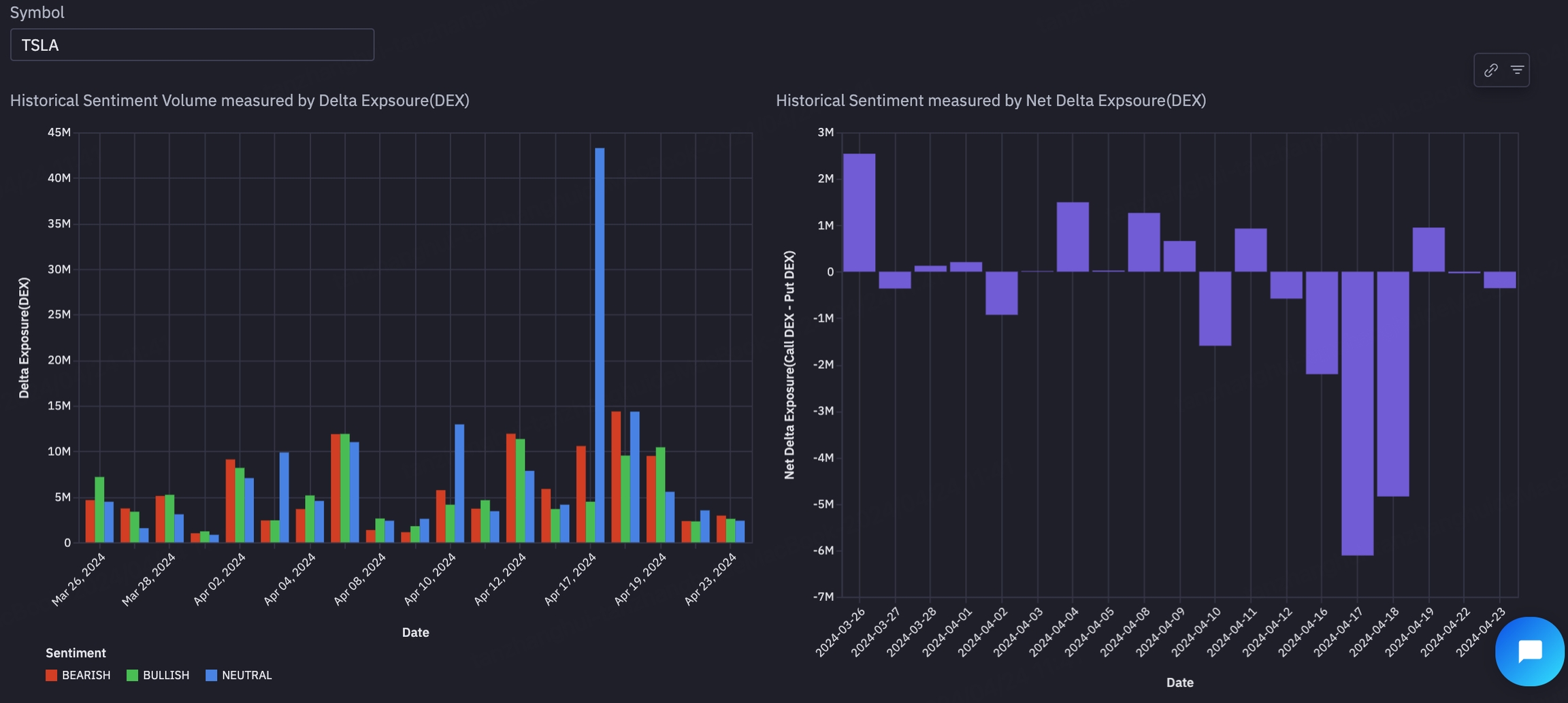

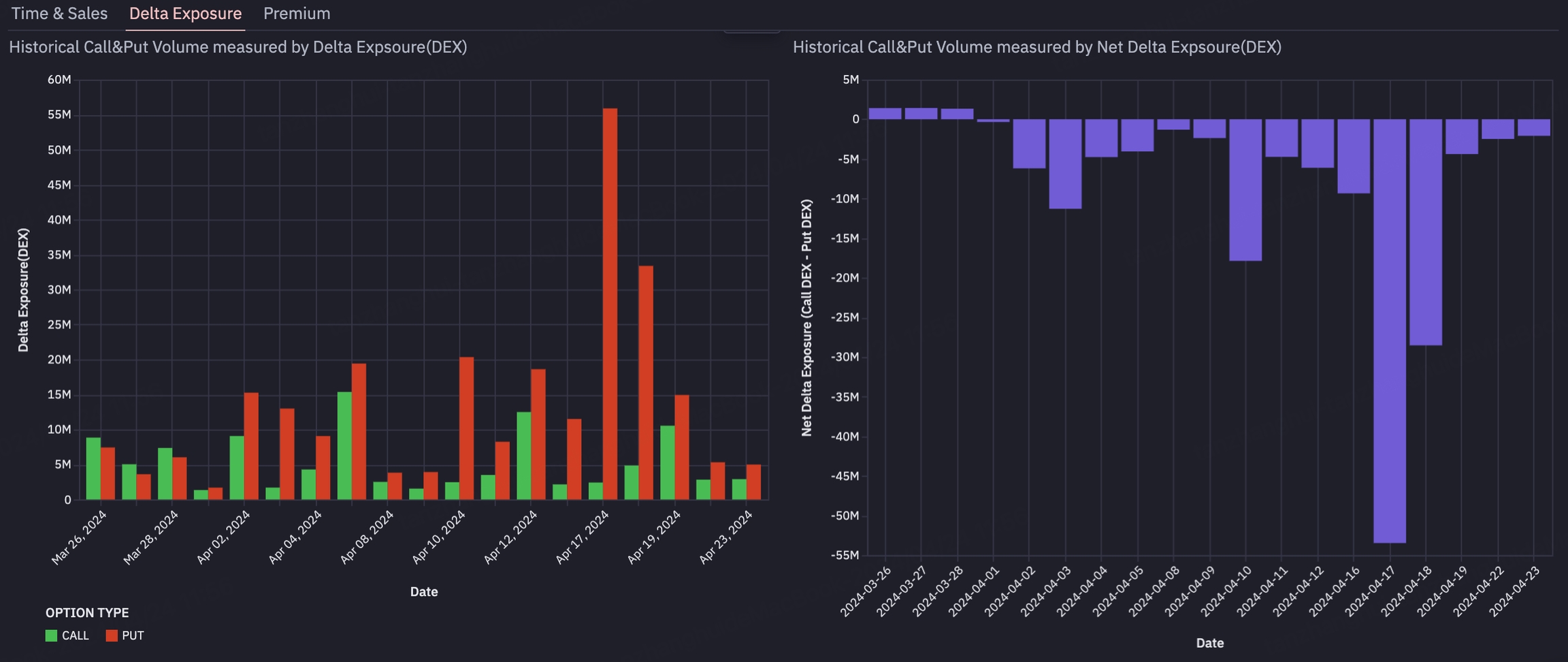

How TradingFlow Uses Delta Exposure

DEX (Delta Exposure)

What is Delta Exposure Imbalance?

Why Delta Exposure Is More Reliable than Premium?

Why Delta Exposure Is More Reliable than Notional Value?

Last updated