GEX and IV

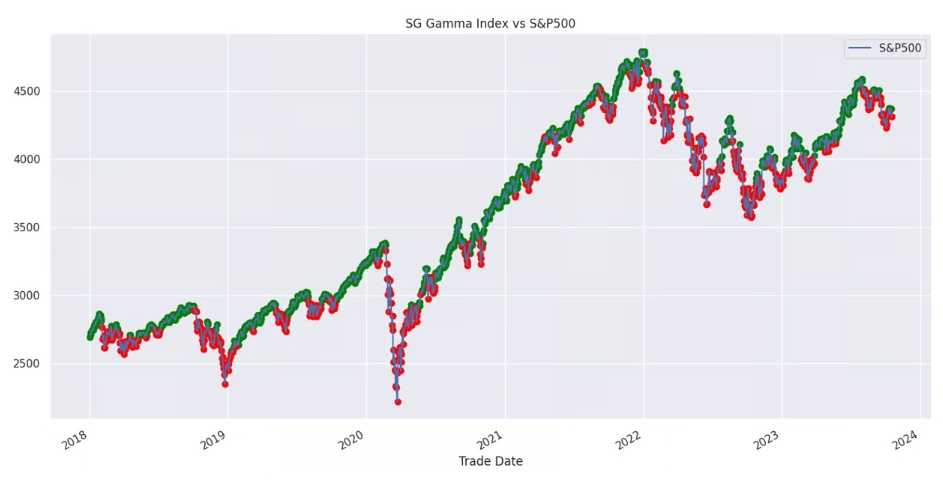

The role of market gamma goes beyond mere classifications of 'bearish' or 'bullish'. While negative gamma is a reliable indicator of heightened realized volatility, historical data reveals that it predominantly characterizes deep market corrections and bear phases. The dots representing the market gamma status are determined at 3 a.m. EST, which is 6.5 hours prior to the market's opening.

Last updated