⛸️Realtime Option Trades Flow

Overview

Options flow has become a powerful tool for traders looking to uncover market sentiment and spot unusual trading patterns. With millions of contracts traded daily, identifying valuable signals requires filtering out noise and focusing on what truly matters.

What is Smart Option Flow?

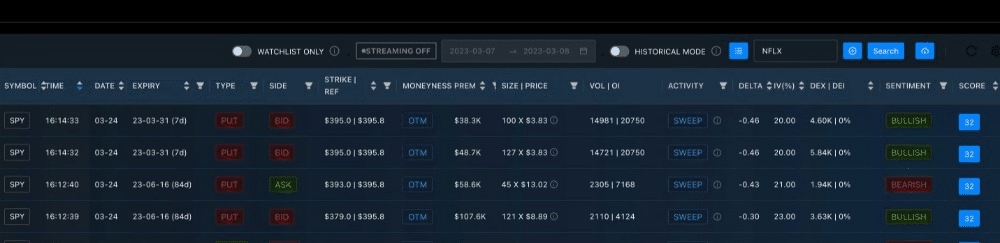

Smart Option Flow delivers real-time and historical data on Unusual Options Activity (UOA) — trades that deviate from normal market behavior, often associated with institutional hedging or positioning.

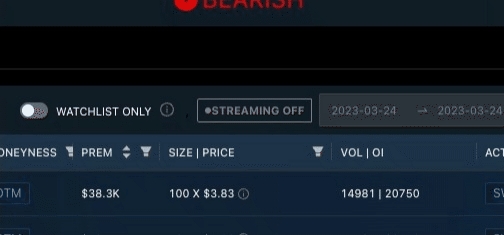

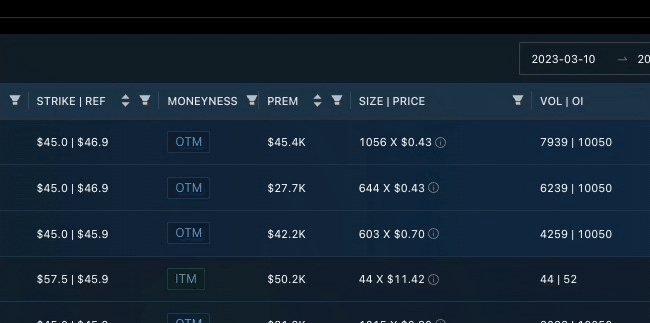

Minimum trade size: Only includes trades with premiums ≥ $25,000, helping filter out retail noise.

Latency: Typically updated within 1 minute, providing near-real-time data.

Why Unusual Options Activity Matters

What UOA Can Reveal:

Mis-pricing opportunities – Large trades can distort options pricing, creating potential entry/exit points.

Hidden sentiment – Sudden surges in volume or premium may hint at market-moving catalysts that haven’t been priced in yet.

Smart money clues – Big trades (especially those above $25K) are likely from hedge funds or institutions—offering insights into their moves.

But Keep in Mind:

Not all UOA is speculative:

Institutional Hedging is a common reason behind large trades.

These traders often seek protection rather than profits, especially around events like earnings or major news.

Selling core stock holdings is costly—hedging with options is often more efficient.

Using Real-Time Streaming Mode

Enable real-time streaming to receive a live feed of new trades—no manual refresh needed.

Customize Your View

Watchlist: Add your preferred symbols to a watchlist and filter Smart Flow accordingly.

Filters & Sorters:

Most columns offer dropdown filters. Set min/max values to narrow results.

Leaving a filter blank sets it to 0 by default.

Interpreting the Data Effectively

How to Analyze a Trade

Impact: Consider size, relative volume, and how it compares to past patterns.

Intent: Use context like price movement, implied volatility changes, and market news to infer if the trade is speculative or defensive.

Limitations of Smart Flow

Not full coverage: Trades with premiums under $25K are excluded.

High-volume environments may lead to occasional missed trades due to technical limitations.

Final Thought

Analyzing options flow is as much art as science. Spend time reviewing historical data, tracking patterns, and building strategies that align with your style. With practice, Smart Flow can become a powerful component of your trading toolkit.

Last updated