OI Analysis

How to Track Traders' Activities through IO Changes

Electric vehicle stock Nikola has seen a continuous uptrend at the end of March in 2024, with its stock price nearly doubling. As the stock price surged, the options trading volume for $NKLA also increased significantly.

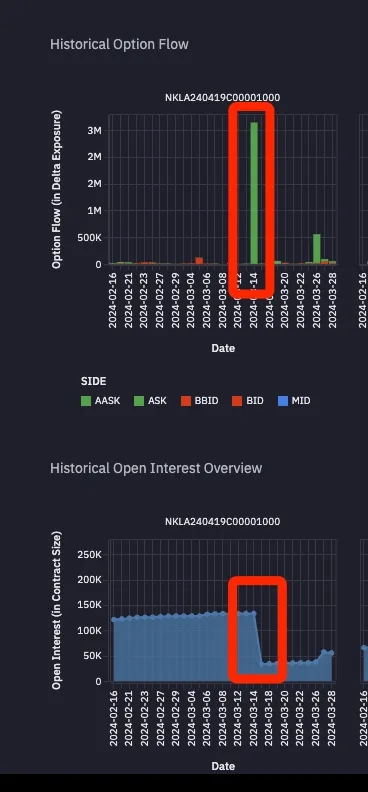

Even before the start of the $NKLA uptrend, there was notable attention on the unusual options trading volume (see the chart below). On 14th March 2024, there was an anomaly in $NKLA Call options with an expiration date of 19th April and a strike price of $1, where the trading volume significantly exceeded the daily average. However, judging from the steep decline in the open interest (OI) value, this is most likely a "buy to close" operation. In other words, an investor likely closed out the previous sell call position before the substantial rise in $NKLA.